Stop Chasing Portfolio Companies for Quarterly Data

Automate the data collection, LP reporting, and ESG compliance that consumes your deal team's time

Sound Familiar?

Common challenges PE firms face

Portfolio Company Chase

Your team sends 47 emails per quarter chasing the same KPIs from the same companies

LP Report Assembly

Four analysts spend two weeks every quarter copying data between spreadsheets

Article 8/9 Pressure

LPs now require SFDR PAI indicators and TCFD disclosures you cannot produce

Fund II vs Fund III

Each vintage has different templates, different metrics, different chaos

How AltoaX Helps

Purpose-built for private equity operations

One Request, Every Company

Send standardised data requests to all portfolio companies with one click. Auto-reminders until they respond.

LP Self-Service Portal

Capital accounts, K-1s, quarterly letters, and IRR by vintage. LPs stop emailing your IR team.

SFDR Article 8/9 Ready

Pre-mapped PAI indicators and TCFD templates. Export audit-ready disclosures for your fund documents.

Cross-Fund Analytics

Compare TVPI, DPI, and MOIC across funds, vintages, and sectors in one dashboard.

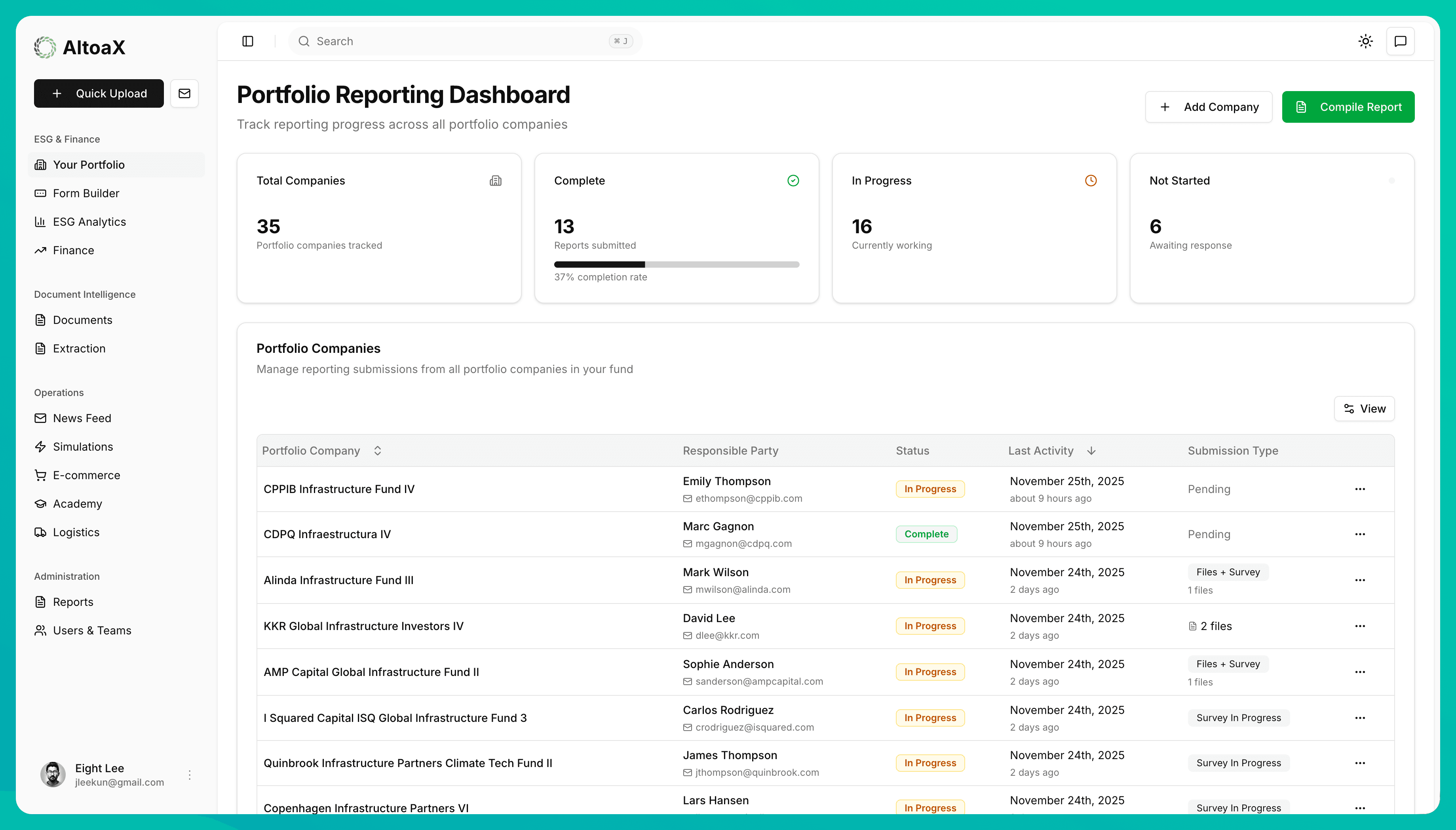

Monitor portfolio company performance, ESG metrics, and LP reporting in one view

Built for Private Equity

Features that address your specific needs

Portfolio Analytics

Real-time dashboards, KPIs, and performance metrics

Spreadsheets

Excel-like formulas with PE/VC functions (TVPI, DPI, RVPI, MOIC)

Document Intelligence

AI-powered extraction from PDFs, Excel, images, and scans

Investor Portal

Self-service access with capital accounts and documents

Ready to Cut Reporting Time by 80%?

See how PE firms collect portfolio data in days, not weeks

Book a Demo